All Categories

Featured

Table of Contents

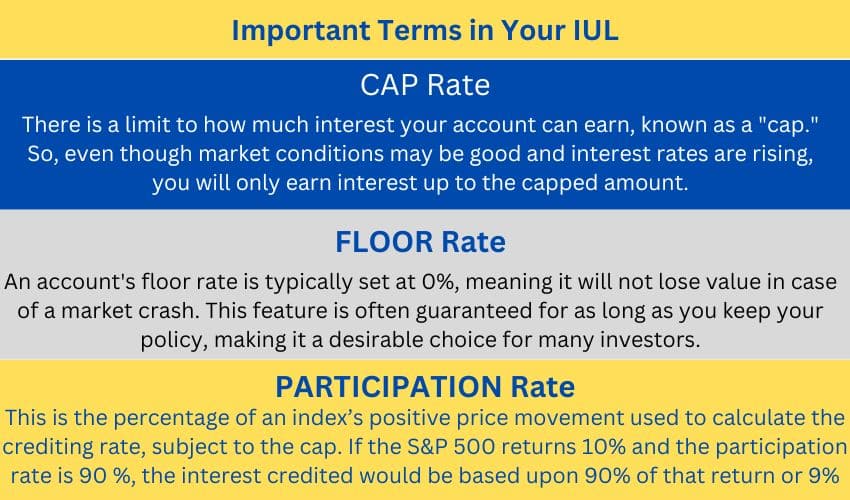

Indexed global life policies use a minimal guaranteed rates of interest, additionally referred to as a rate of interest crediting flooring, which lessens market losses. Say your cash money value loses 8%. Many business provide a floor of 0%, suggesting you won't lose 8% of your financial investment in this situation. Realize that your cash money worth can decrease even with a floor due to costs and various other prices.

A IUL is an irreversible life insurance policy that obtains from the residential properties of a global life insurance policy. Unlike global life, your cash value grows based on the performance of market indexes such as the S&P 500 or Nasdaq.

What makes IUL various from various other plans is that a part of the superior repayment goes right into annual renewable-term life insurance policy. Term life insurance, additionally recognized as pure life insurance coverage, guarantees death benefit repayment.

An IUL policy may be the right selection for a client if they are seeking a long-lasting insurance item that builds riches over the life insurance policy term. This is because it offers potential for development and likewise preserves one of the most worth in an unsteady market. For those who have significant assets or wide range in up-front financial investments, IUL insurance will be a wonderful wide range monitoring device, specifically if a person wants a tax-free retirement.

Can I get Indexed Universal Life Tax Benefits online?

The price of return on the policy's money worth fluctuates with the index's activity. In comparison to other plans like variable universal life insurance policy, it is less dangerous. Motivate customers to have a conversation with their insurance coverage agent about the most effective choice for their situations. When it comes to caring for beneficiaries and managing wealth, below are some of the leading reasons that someone might choose to choose an IUL insurance coverage: The cash money value that can build up as a result of the rate of interest paid does not count toward profits.

This indicates a client can use their insurance payout instead of dipping right into their social security money prior to they are ready to do so. Each plan must be customized to the customer's personal requirements, particularly if they are managing substantial possessions. The insurance policy holder and the agent can choose the quantity of risk they take into consideration to be proper for their needs.

IUL is a total easily flexible plan for the most part. Because of the rates of interest of universal life insurance policy plans, the rate of return that a customer can possibly receive is greater than various other insurance coverage. This is due to the fact that the owner and the agent can take advantage of call alternatives to increase feasible returns.

What does a basic Iul Policyholders plan include?

Insurance holders might be brought in to an IUL policy since they do not pay funding gains on the additional money worth of the insurance coverage policy. This can be contrasted to various other plans that call for tax obligations be paid on any cash that is secured. This implies there's a cash possession that can be gotten any time, and the life insurance policy policyholder would not have to fret concerning paying tax obligations on the withdrawal.

While there are various benefits for an insurance policy holder to select this sort of life insurance policy, it's not for everyone. It is very important to allow the consumer understand both sides of the coin. Below are a few of one of the most crucial points to urge a customer to consider prior to choosing this option: There are caps on the returns a policyholder can get.

The most effective choice depends upon the client's risk resistance - Indexed Universal Life loan options. While the costs related to an IUL insurance plan are worth it for some consumers, it is necessary to be upfront with them concerning the costs. There are exceptional expense costs and other management costs that can start to build up

No guaranteed interest rateSome other insurance policies use a rate of interest rate that is ensured. This is not the case for IUL insurance policy.

Is there a budget-friendly Guaranteed Iul option?

Consult your tax, lawful, or audit expert concerning your private situation. 3 An Indexed Universal Life (IUL) plan is ruled out a safety and security. Costs and survivor benefit kinds are flexible. It's crediting price is based on the performance of a stock index with a cap price (i.e. 10%), a floor (i.e.

8 Long-term life insurance policy contains 2 kinds: entire life and global life. Cash value expands in a taking part entire life policy via dividends, which are declared yearly by the company's board of supervisors and are not guaranteed. Money value expands in a global life plan with credited interest and lowered insurance policy expenses.

What does a basic Guaranteed Interest Indexed Universal Life plan include?

Despite how well you intend for the future, there are events in life, both expected and unexpected, that can affect the economic health of you and your liked ones. That's a factor permanently insurance. Survivor benefit is normally income-tax-free to recipients. The survivor benefit that's typically income-tax-free to your beneficiaries can help guarantee your family members will be able to maintain their criterion of living, aid them keep their home, or supplement shed income.

Things like potential tax obligation boosts, rising cost of living, economic emergency situations, and intending for events like university, retirement, and even wedding celebrations. Some types of life insurance policy can aid with these and various other issues too, such as indexed global life insurance policy, or merely IUL. With IUL, your plan can be a funds, because it has the prospective to develop value gradually.

An index might affect your passion attributed, you can not spend or directly get involved in an index. Right here, your plan tracks, yet is not actually invested in, an outside market index like the S&P 500 Index.

Costs and expenses might reduce policy values. You can likewise choose to receive fixed interest, one collection predictable passion price month after month, no issue the market.

What are the top Indexed Universal Life Vs Term Life providers in my area?

That leaves much more in your plan to possibly keep growing over time. Down the road, you can access any kind of offered cash money worth via policy fundings or withdrawals.

Latest Posts

Index Insurance Company

What Is Better Term Or Universal Life Insurance

Guaranteed Universal Life Insurance Companies